Corporate Finance is the largest service line. Under these service lines, we provide services that cater to the various needs of clients ranging from business restructuring to Mergers & Acquisitions (M&A) and private placements to disposal of assets. Mergers & Acquisitions are defined as the consolidation of companies. A Merger is a combination of two companies to form one, while an acquisition is one company taken over by another company. M&A is one of the major aspects of the corporate finance world. The reasoning behind M&A generally given is that two separate companies together create more value compared to being on an individual stand. With the objective of wealth maximization, companies keep evaluating different opportunities through the route of merger or acquisition.

Business Finance

Our Brochure & Company Profile

To read more about the services provided by RBS, please see our detailed brochure and our company profile.

Tags

Business Finance

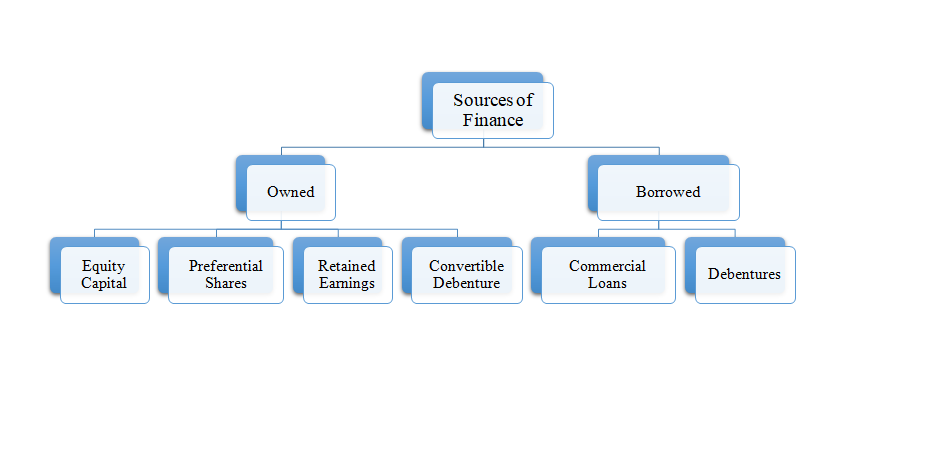

Raising the right type of finance for a business startup is vital. It’s still proving a tough time for businesses and entrepreneurs, but funding is available for most businesses – even in tricky situations. With a business plan in place and clear objectives, we can build up a detailed understanding of your business, and help you to find the appropriate financier.

“We provide you with the optimum solution for your corporate finance transactions, by adopting a proactive and quality-driven approach for your transaction execution.”

Business Finance (Key Points)

- Mergers and Acquisition

Mergers & Acquisitions can take place:

- by purchasing assets

- by purchasing common shares

- by an exchange of shares for assets

- by exchanging shares for shares

We specialize in Business Finance in providing these services specifically tailored to each client’s specific requirements. We work closely with numerous financial institutions and know-how to source the best type of finance for business startups. When raising finance, we also assist you to negotiate terms and conditions with the financiers and help with the completion of the detailed contractual paperwork.