Corporate Tax

Team What is a global minimum tax and what will it mean?

Base Erosion and Profit Shifting (BEPS) practices cost countries 100-240 billion USD in lost revenue annually, which is the equivalent to 4-10% of the global corporate income tax revenue.

Working together in the OECD/G20 Inclusive Framework on BEPS, 141 countries and jurisdictions are implementing 15 Action Point Plan to tackle tax avoidance, to improve the coherence of international tax rules, to ensure a more transparent tax environment and address the tax challenges arising from the digitalization of the economy. Salient features are as follows:-

- 1. 136 countries have signed a deal aimed at ensuring companies pay a minimum tax rate of 15%.

- 2. The global minimum tax rate would apply to overseas profits of multinational firms with 750 million euros ($868 million) in sales globally.

- 3. The countries behind the global minimum tax rate together account for over 90% of the global conomy.

- 4. The OECD, which has steered the negotiations, estimates the minimum tax will generate $150 billion in additional global tax revenues annually.

The agreement calls for countries to bring it into law in 2022 so that it can take effect by 2023, accordingly, UAE has introduced a corporate tax on January 31, 2022.

United Arab Emirates New Corporate Tax Regime

UAE has introduced a 9% corporate tax on 31st January 2022 by the Ministry of Finance. Effective from 1st June 2023, the new corporate income tax will become applicable across all emirates of the UAE. The nine percent federal corporate tax is the lowest in the GCC, compared to the rates adopted by the other countries in the GCC

KSA – 20%, Oman/Kuwait – 15%, Qatar – 10% , UAE -9%

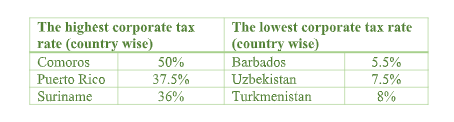

Corporate tax rates around the world in 2021

The worldwide average statutory corporate income tax rate, measured across 180 jurisdictions by Tax

Foundation, is 23.54 percent. When weighted by GDP, the average statutory rate is 25.44 percent. Asia

has the lowest regional average rate, at 19.62 percent, while Africa has the highest regional average

statutory rate, at 27.97 percent. However, when weighted for GDP, Europe has the lowest regional

average rate at 23.97 percent and South America has the highest at 31.03 percent.

What is Corporate Tax?

Corporate Tax is a form of direct tax levied on the net income or profit of corporations and other

businesses.

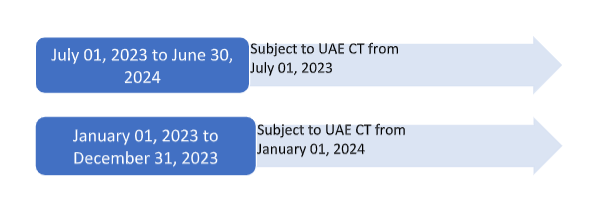

When will the UAE CT regime become effective?

It will become effective for financial years starting on or after June 01, 2023

Who will be subject to UAE CT?

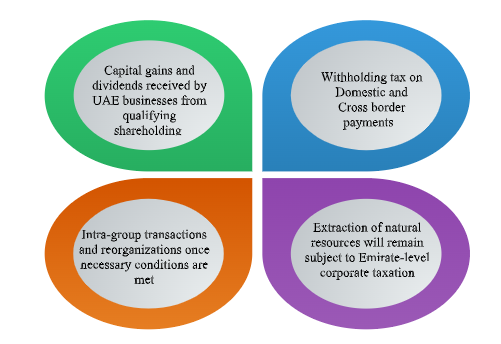

UAE CT will apply to all UAE businesses and commercial activities alike, except for the extraction of

natural resources, which will remain subject to Emirate level corporate taxation.

Will UAE CT apply to businesses in each Emirate?

Yes. The UAE CT is a Federal tax and will therefore apply across all Emirates

What will be the role of the Federal Tax Authority?

The Federal Tax Authority will be responsible for the administration, collection, and enforcement of UAE

CT

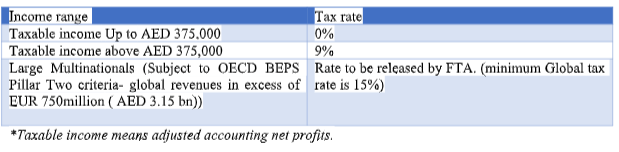

What is adjusted accounting net profit/ income?

UAE has proposed to levy corporate income tax on the adjusted accounting net profits during an

assessment year. The accounting net profits/income of a business is the amount reported in the financial

statements prepared in accordance with internationally accepted accounting standards.

Features of the Announcement

The said announcement has briefly specified the following features of the corporate taxes to be

implemented. The Authority shall publish the further details regarding registrations, guidelines, payments, etc. in due course of time. For now, it has been made clear that the UAE corporate tax regime shall follow best global practices and most likely to be implemented with ease in compliance requirements.

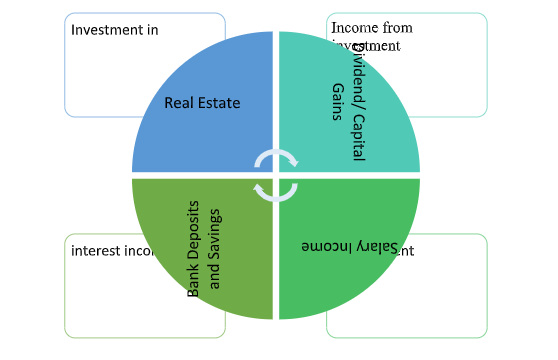

Exemptions available for Individuals in their personal capacity

Exemptions available for companies (others)

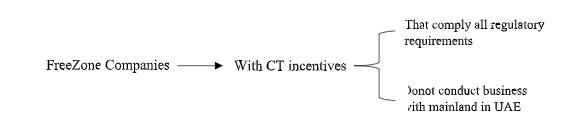

1. Exemptions available for freezone companies

Practically, all export-oriented companies in a free zone will only get

the benefit of corporate taxes. However, all businesses established in

free zones will be required to register and file a Corporate Tax return.

Taxable profits earned by freezone entities from business activities in

UAE mainland is subject to corporate tax

Exemptions available for companies

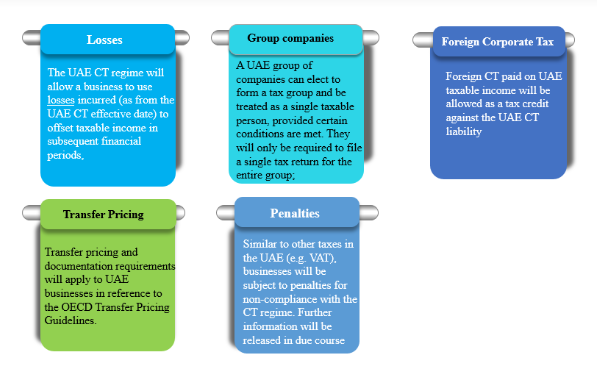

Other Features:

Thus the Introduction of CT is not to hold back the spirit of business in UAE but to reaffirm the UAE’s

commitment to meet international standards for tax transparency and preventing harmful tax practices.